The world seems to be getting ready for new BC-AD analysis (Before Corona and After Destruction) of all spheres- from public to private affairs. The world is going to redefine and realign every sector- from diplomacy to technology to trade practices. Most of the affairs would be frequently appended with De and Re- De-Centralisation, De-Urbanisation, Re-capitalisation, Reconstruction etc.

Just before India ducked against the Corona pandemic, $ 5 trillion economy was the buzzword in all the discourses of Indian economy. This target was to be achieved by year 2025. This target looked very wishful even without being hit by the pandemic as indicators were showing slump in all the sectors of the economy.

The current size of Indian economy is approximately $2.8 trillion economy. To achive the target of $ 5 trillion economy in five years, India needed to return 12 per cent growth per annum, that too in dollar terms. The growth rate was accepted around 5 per cent per annum for Indian economy, although government took this figure as 6 per cent, just before the pandemic hit the world.

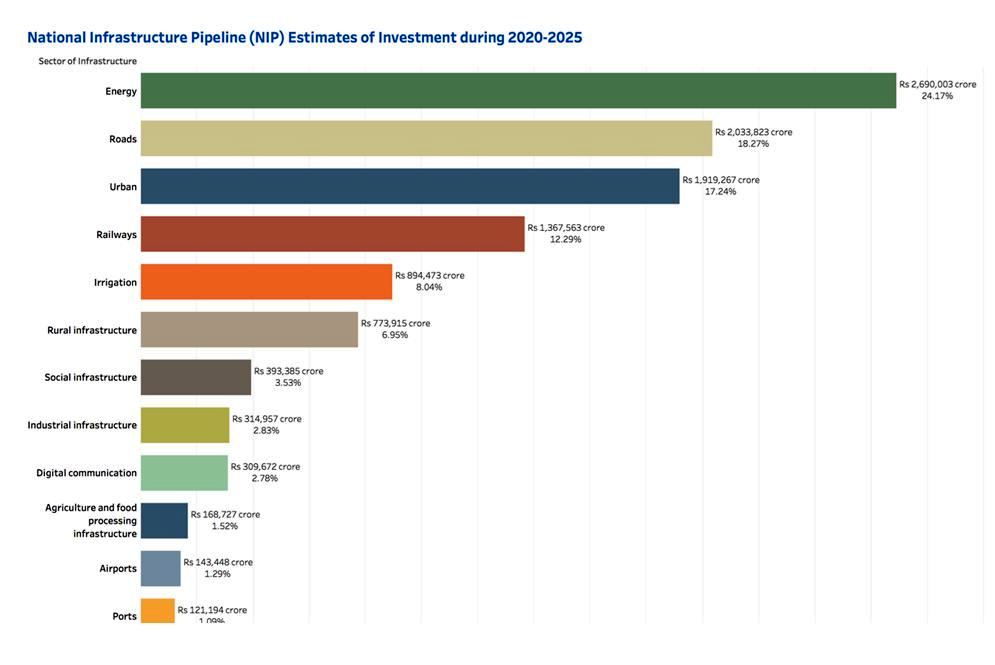

The only positive aspect of this wishful target is the demographic dividend and the size of the market. Government agencies thought ‘creating new and upgrading existing infrastructure will be key to raising India’s competitiveness and achieving the target.’[1] This was deliberated by a high-power Task Force of Government of India which had members from all the departments of Union Government at the highest level and had participation of most of the state governments, NITI Aayog, corporates, financial institutions and industry associations to draw up the National Infrastructure Pipeline (NIP).

The report of the Task Force was submitted on 30th April, 2020. Government thought this area was very critical for the success of the Make in India programme as manufacturing competitiveness critically depended on infrastructure. The report further deliberates that ‘the supply additions through infrastructure development boost short-term as well as the potential rate of GDP growth. Infrastructure creation is also labour absorbing, which boosts employment and income generation in the economy and further spurs domestic demand. Improved infrastructure capacities also create efficiency gains through improved logistics and networks, which would improve the competitiveness of the economy. This can help kick in a virtuous cycle of higher investments, growth and employment generation in the economy.’[2] The projected total infrastructure investment in the report of this task force stands at Rs.111 lakh crore during the period FY 2020 to FY 2025.[3] The sheer arithmetic and composition of the task force underlines the importance of this exercise for the future of Indian economy.

It is evident that the thinking in government has not changed and the factors and catalysts of the desired results in the economy have remained unchanged by large. But then, there is a disconnect between the report and the actions that are being taken in different departments of the union government and the state governments. UNDP very carefully suggested:“Policymaking processes must be adapted and upgraded to better manage complexity, deploy open policy making approaches and apply systems and design thinking to strengthen impact and integration, while expanding government’s ability to plan for a range of possible threats and stresses.”[4]

At the United Nations Sustainable Development Goal Summit in 2019, world leaders identified six “transformative entry points” to accelerate progress towards the SDGs. These entry points present development challenges that are interlinked, complex, and integrate goals and targets across the SDG framework. As per UNDP the entry points are of crucial relevance for the Asia Pacific region. Accelerated progress in these areas will be key to countries’ progress towards achieving the goals of the 2030 Agenda.[5]

They are:

- Strengthening human well-being and capabilities;

- Shifting towards sustainable and just economies;

- Building sustainable food systems and healthy nutrition patterns;

- Achieving energy decarbonization and universal access to energy;

- Promoting sustainable urban and peri-urban development;

- Securing the global environmental commons.

Let us examine the reality of important sectors of Indian economy:

Labour and Employment

It is expected that by 2025 India and China will have the same working-age population and by 2030 India will have highest working age population at 1.03 billion which will be about 68 per cent of total population.[6] And, the median age projected for India will be 31 years, comparing 40 years for USA and 43 years for China. As per government “This will be an important growth booster.”

In usual circumstances, yes, it is a booster, but post-COVID the positive curve of demography may turn against the government. This is going to be a big challenge for any government to provide adequate job opportunities- both in terms of quantity and quality. Apart from joblessness, underemployment is the major threat the world is going to face in every sector.

It was expected that by 2030 urban areas will provide 41 per cent of job opportunities. This percentage was only 29 per cent in 2012 as per NSSO data. Contribution of urban areas in total employment will increase at a higher rate than the contribution of rural areas during the period 2018-30. On this assumption of shifting of the employment base, there was a big focus on urban infrastructure. The ongoing pandemic has left enough hint of de-urbanisation in development economies. There is an immediate need to re-assess the rural-urban employment opportunities in the changed circumstances and the resource allocations accordingly.

In the UNDP Report of 2020, India was found in the ‘fast risers’ category among the ‘strengthening human well-being and capabilities’, but the orientation was more towards the urban and service sectors when the data was collected for the study. India needs to take a major reskilling drive in post-pandemic era to make it more inclusive and more useful for the economy.

Priority to Service-Based Economy

It was estimated that the share of services in total employment in India will grow from 27 per cent in 2012 to 48 per cent in 2030, while that of agriculture will reduce from 49 per cent in 2012 to 29 per cent in 2030. The share of industry in total employment is expected to remain at ~24 per cent during 2012-30. These trends are reflective of India’s economy gradually transitioning from an agrarian economy to a service-centric economy. This simplistic deduction also needs to be revisited. Most of the service sectors will take long time to get back to their normal selves. There are enough indications of more manpower engaging in agriculture sector in the forthcoming years.

As per the report of NPI during the fiscals 2020 to 2025, sectors such as energy (24 per cent), roads (18 per cent), urban (17 per cent) and railways (12 per cent) amount to ~71 per cent of the projected infrastructure investments of Rs. 111 lakh crore in India. Digital communication (2.78 per cent) has more allocations than the agriculture and food processing infrastructure (1.52 per cent). In fact,estimated investment in energy sector (24.17per cent) alone is much more than in the irrigation(8.04 per cent), rural infrastructure(6.95 per cent), social infrastructure (3.53 per cent) and agriculture and food processing infrastructure (1.52 per cent) sectors, all put together.

Considering the changed and changing circumstances sectoral priorities and related infrastructure planning need to be realigned prudently and seriously.

Infrastructure spending

As per the Global Infrastructure Outlook 2017 published by Oxford Economics, the estimated global infrastructure investment requirement is $94 trillion during the period 2016 to 2040. Out of this envisaged infrastructure investment, ~50 per cent is required in Asia alone (with China, India and Japan being major contributors), and with roads and electricity sub-sectors constituting ~67 per cent of these investment needs. Another study has estimated that while the demand of infrastructure is growing at about $4 trillion per annum, the supply of infrastructure is growing at only $2.7 trillion annually, leading to a deficit of $1-1.5 trillion on a per annum basis.

It is estimated that India would need to spend $4.51 trillion on infrastructure by 2030 to realise the vision of a $5 trillion economy by 2025, and to continue on an escalated trajectory until 2030.

The National Infrastructure Pipeline (NIP) is planning its affairs in the usual directions, whereas it was required to appreciate the possible changes in demographics in India and worldwide. Now through NIP or any new task force which takes cognizance of changed scenarios need to reassess the resources available for the country and the areas of priority. For example, health and agriculture were not very high in the priority sectors, but in the current circumstances these sectors have scaled up in the priorities.

Financial Sector Reforms

India was put in the ‘sprinters’ quadrant in ‘Shifting towards sustainable and just economies’ and the major contributors to this success was the programmes related to financial inclusions, such as ‘Jan Dhan Yojana’ and ‘Mudra Yojana’.

This progress came handy when governments could push cash through Direct Benefit Transfers (DBT) platforms.

However, financial inclusion is a very small component of financial sector reforms. This is a very vast subject which includes reforms related to monetary, fiscal and external sectors, apart from financial markets and financial institutions.

In the banking sector as far as institutional reforms are concerned, there are some positive developments by which many banks have been amalgamated and management of banks improved. But, at the same time, interference of government in banking business has increased manifold. The increasing NPA is a serious threat to economy.

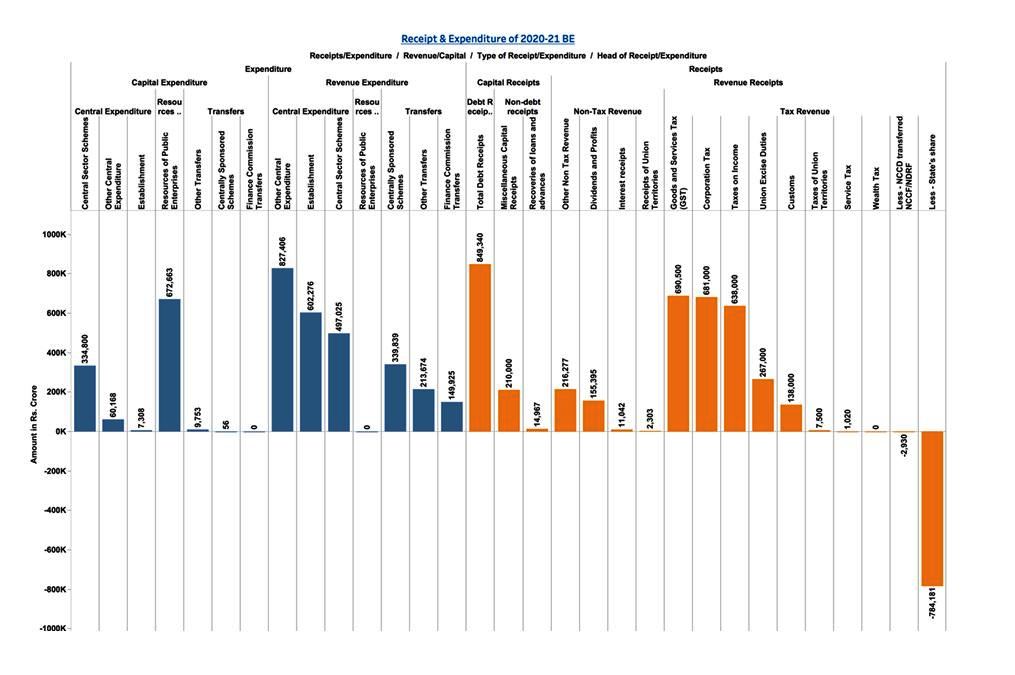

Cash Management issues

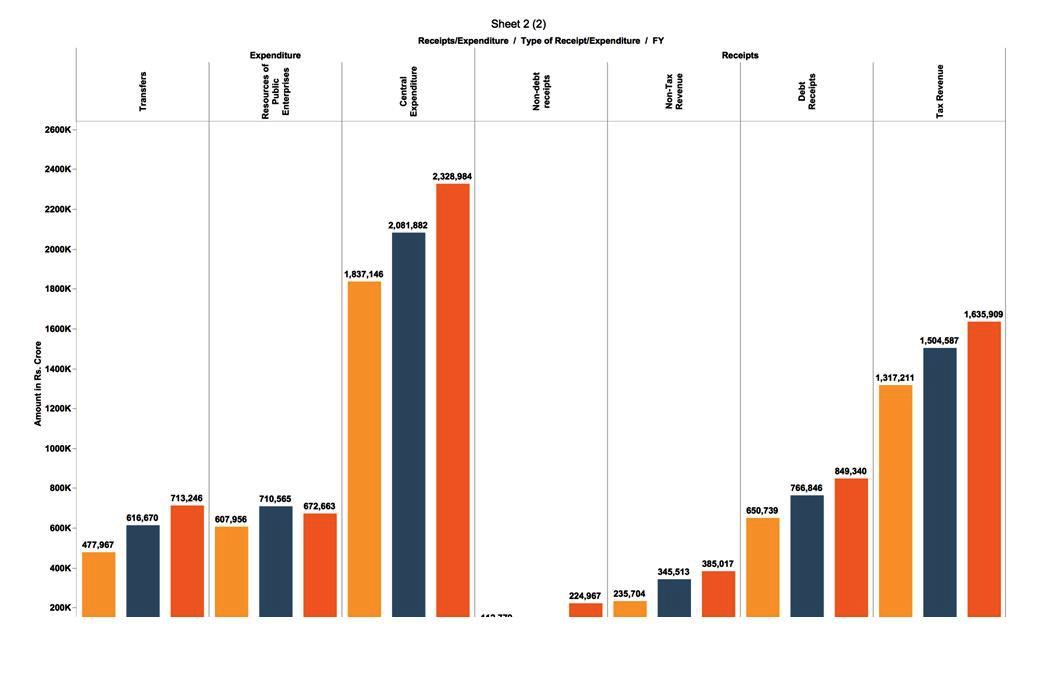

This year governments are facing twin challenges of significantly lower revenue mobilisation and higher expenditure to accommodate the extra funding requirements of the relief and incentive packages, and, government of India is no exception to it. This situation has compelled the government to take steps one after another for better cash management and debt management. This is also the high time, if not the right time, to exercise better financial discipline and control in government spending.

Priority and non-priority spending

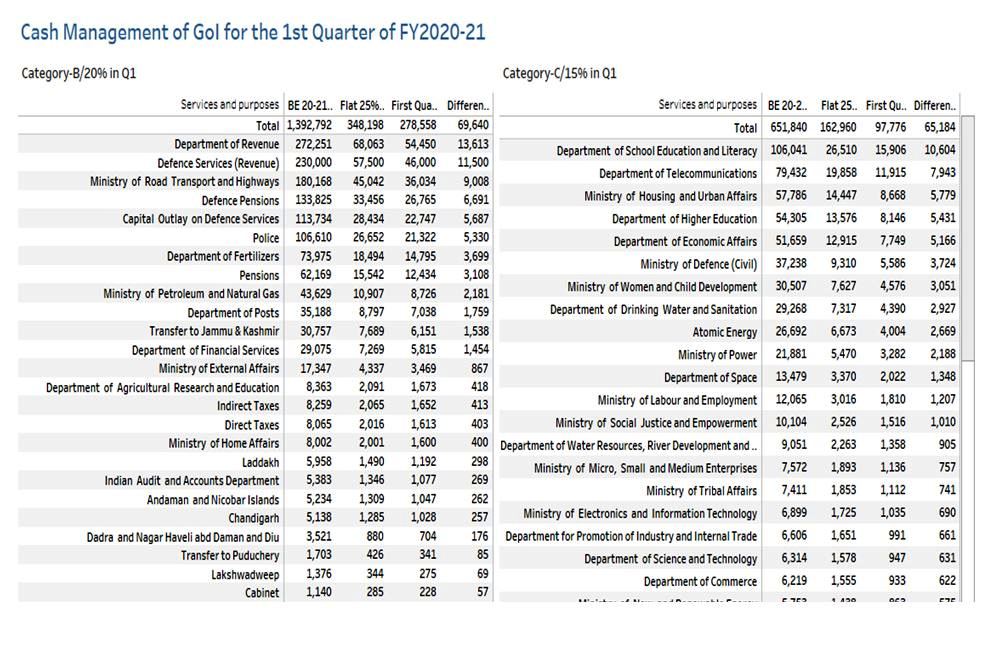

Keeping in view the present situation arising out of COVID-19 and the consequential lock down in the very first week of the current fiscal Government of India realized that cash position of government will be stressed in the first quarter. So, Government Departments and Ministries were divided in three categories- A, B and C. Departments/ministries in the Category A were allowed to do their usual limit of expenditure of 25 per cent of the BE 2020-21 in the first quarter (April to June). In the Category-A there are 20 ministries/departments. 28 departments/ministries were put in Category B and they were asked to limit their expenditure to 20 per cent in the first quarter. Rest 52 departments/ministries were put in Category C and their expenditure was restricted to 15 per cent in the first quarter.

It was curious to find MSME and scientific departments of Government of India in Category C. These departments were expected to be pro-active and contribute in their fullest capacities to overcome the distress.

Although pace of expenditure was to slow down in its usual course as well because of the lockdown and other limitations, this measure was taken considering the lower flow of revenues. By taking this measure the government saved liquidity worth Rs. 1.34 lakh crore. This measure will help the government in eventually reducing the budget of most of the ministries and departments for this financial year and also in relocating funds for the priority activities.

Freezing of Dearness Allowance (DA) and Dearness Relief (DR)

Government of India also decided that the dearness allowance payable to central government employees and dearness relief to central government pensioners, due from January 2020 shall not be paid. The additional instalments of dearness allowance and dearness relief due from July 2020 and January 2021 shall also not be paid. Approximately,Rs. 40,000 crore will be the saving for the union government by freezing the DA of about 48 lakh serving employees and DR of about 65 lakh pensioners.

It is estimated that if state governments also follow the suit, they may also save about Rs. 85,000 crore.

Tracking the unspent balances

On the one hand government’s liability is increasing in terms due to borrowings every year and on the other hand lakhs of crore rupees are lying unutilized with the state governments and other agencies implementing government schemes. Treasury operations of the states show that substantial amount of surplus cash available with several of the states is invested in Treasury Bills for earning interest. This is definitely a poor example of financial management.

The Ministry of Finance has issued circulars to the central ministries and departments to take stock of the unspent balances and release any further grants to the implementing agencies only when there is no parking of funds.

Implementing Treasury Single Account (TSA)

Now that government is facing the acute shortage of revenue due to prolonged restrictions on the movement of goods, services and the labour, government is going to count every penny that is going to be spent.

Treasury Single Account is a mechanism through which all possibilities of the floats will be eliminated. Government of India has pushed this reform after pandemic impact. All the departments and ministries have been asked to implement this at the major cost centres. Idea of treasury single account is to have all the major transactions at the central bank level, so that money goes out of the exchequer only when actual transactions happen and government does not have to bother about receiving utilisation certificates for the grants that it has released. This also helps government to aggregate its resources on daily basis and plan its borrowings on the actual requirements and on perceived liabilities or trend analysis. In the first batch Government of India has decided to implement TSA in the major autonomous bodies of the ministries and departments of the union government.

Reforms in Budget Management

When lockdown was announced in India, it was the last week of the financial year 2019-20. Many appropriations were just cleared by the Parliament for further course of actions by the ministries and departments. Most of the ministries and departments spend about 10 per cent of their allocated budget in the last ten days of the financial year. This is a bad example of budget execution, but a reality.

Government of India took two decisions in March 2020 which may prove very effective from the financial management point of view. The government decided to authorise departmental secretaries of all re-appropriations that required approval of the Ministry of Finance earlier. This decision helped the line ministries to take quicker decisions and smoother implementation. Although this was meant only for 2019-20, but this experience will help government to consider devolution of more autonomy to the line ministries.

To have better discipline in expenditure the Ministry of Finance issued a directive in January, 2020 through which departments and ministries could not spend more than 25 per cent of their budget in the last quarter of the financial year. This limit was 33 per cent before this order. For the last month the limit was reduced to 10 per cent of the budget, which was 15 per cent earlier. This directive will help ministries and departments to take decisions at a more even pace. The earlier flexibilities resulted in a rush of expenditure and lack of diligence in the last quarter and last month of any financial year. This reform will have a good impact on decision-making and be less of a burden on the borrowings of government.

Digital payments

Government of India has almost eliminated the expenditure through cheque or any paper mode in the civil ministries and departments. Most of the payments are electronic. Public Financial Management System (PFMS) is the platform through which transactions happen. In the last financial year there were more than 100 crore transactions on PFMS worth more than 30 lakh crore. In the current fiscal too there are 24.35 lakh transactions on PFMS worth Rs. 5 lakh crore.[7] Digital payments are quick and direct. It has reduced the level of corruption also to a great extent. Now it is high time to onboard non-civil ministries and departments on PFMS to leverage the benefit of digital payments to all the sectors and their beneficiaries.

References

1 Page-17, Report of the Task Force on National Infrastructure Pipeline (NIP), Ministry of Finance, Government of India, released on 30th April, 2020

2 Page-17, Report of the Task Force on National Infrastructure Pipeline (NIP), Ministry of Finance, Government of India, released on 30th April, 2020

3 Page-13, Report of the Task Force on National Infrastructure Pipeline (NIP), Ministry of Finance, Government of India, released on 30th April, 2020

4 Page-X, Fast-Tracking the SDGs Driving Asia-Pacific Transformations, UNDP, 2020

5 Page-3, Fast-Tracking the SDGs Driving Asia-Pacific Transformations, UNDP, 2020

6 United Nation Population Division (UNDP) Report